There’s endless hype on the market between the diehard: “Google’s’ traffic is still the dominant force in search by a longshot, why waste your time for the peanuts AI is sending your way?”. And the AI enthusiasts contradicting their comrades in SEO with promises of the death of organic search as we know it.

Where there’s disruption, there’s noise. It’s hard to focus when you can’t zero in on the truths. And the truth lies somewhere in between “Google owns search, period.” and “Search is dead.”.

As marketers, you know that there’s no silver-bullet channel. Marketing investment has never been an either or conversation. It’s always been a calibration conversation. Do you bet more earlier? Do you hedge? Do you hold?

The truths:

- Search and other traditional or ‘pre-AI’ channels almost certainly are still majority contributors to your bottom line

- AI as a channel is rapidly growing (despite its small share), it is gaining speed as a channel for your customers to find answers and to find you

- AI is fundamentally changing the ways that people find answers in digital

The last point is the most important. Whether or not there’s a fundamental shift in investment and channel mix, that user behavior change is what will shape the future of marketing.

But when do you start to give a damn? That’s where we turn to data.

Our study creates a framework for you to define your key KPIs so that you can continue to calibrate your marketing strategy for what’s working today, next month, and 12 months from now.

3 key elements to incorporate when preparing for marketing change:

- Growth/Potential Growth

- Industry Specific Data

- Customer Behavior

The Acceleration Story: AI Search Data Trends Show True Momentum

We’ve pulled data from the last 16 months of Seer client datasets to better understand signals in AI traffic behaviors. When we pulled the YoY change of 7,000% increase in AI traffic, the reaction wasn’t “omg, wow”, it’s “no shit”. Why? Because we weren’t having anything remotely close to the conversation about AI in search we were having today as of last Summer.

And that’s the point. This is changing fast.

Which is why we also looked at the past few months of data. We saw substantial growth. In context 113% is much more “wow” than 7000%.

In May-July 2025, AI traffic grew 113% from the 3 months prior.

By the numbers mapping this is a rollercoaster. It is clear, however, that AI traffic is growing significantly.

If we try to forecast based on compound growth, we get a number (265%) [probably unsustainable, but I guess never say never?]. So for experimentation’s sake, let’s split the difference of our last two periods of growth: 113% and 23%, at 68%.

To be clear: this is obviously a scenario, not a forecast. Anyone who gives you a declarative forecast at this point … ignore them. It is interesting to see, if we grow at some not-unlikely number the next 4 quarters, we’re talking 8X growth in the next year:

Let’s game out a scenario where we anchor in our lowest growth period of 23%. Traffic is still doubling by next summer (2.3X)

But: Does AI Traffic Matter if it’s Still a Small Piece of the Pie?

That’s the fight you’re seeing everywhere right now. Does it even matter that this could be 8x next year if Google still owns the vast, vast majority of traffic volume?

We believe it does matter. Why?

Because of that acceleration. Yes, we are still talking about a fraction of a percentage of growth. But that growth is compounding, and fast.

Not just our client data, but the data across the board shows that (1) Google Search is not dying anytime soon and (2) humans are starting to adopt AI more consistently into their journey.

Rand Fishkin will be the first to point out that dude, “AI is not killing search”, but the data Spartoro and Datos are starting to show about AI search correlating with search growth begs some pretty interesting marketing questions.

At the end of the day: your customer is looking for the answer. It’s in no way better for them to click through to your website vs. get the answer from your website (whether they know it or not) via an AIO or ChatGPT. The point? The more you remove friction, the more you will be the source of answers.

So it’s growing? It’s not growing? WTH? Two factors you should consider when you’re wondering just how concerned about the growth in AI you should be:

- Industry: How quickly are things actually changing in your world and how competitive do you need to be?

- Conversion Rate: The efficiency matters. 1M visitors isn’t impressive if it converts at the same rate as the channel giving you 10M visitors. But it is interesting when the CVR is 10x

Industry-Specific AI Traffic Growth

Some industries will be slower than others. But no industry will have 0 impact.

This shouldn’t be your determination of whether or not you’ll “ever” need to prioritize AI. But your signal on how fast you need to move now.

Business Services is seeing AI-driven sessions for the first time >1%.

At no point before February of this year was AI traffic in business services ever greater than .5%. So if we compare the highest recent month of 1.1% in June to LY, in Business Services AI-driven sessions have grown .05% to 1.1% YoY.

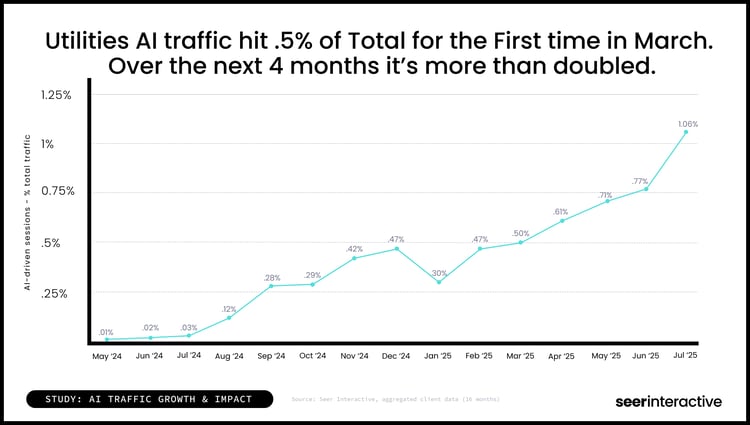

Utilities also grew AI sessions to >1% in May-July of 2025

Utilities AI traffic only just hit .5% for the first time in March. Over the next 4 months it’s more than doubled.

Software and Education being the next two industries following closely, hitting in the .71% in July. Smaller numbers, but consider:

- In January, Education was at .31%, and is now 2.3X that

- In January, Software was at .27% and is now 2.6X that

Conversion Rates as a Key AI-Traffic KPI

The age-old debate of whether or not traffic should be the KPI if it doesn’t *do* anything brings us, naturally, to layering in conversion rate.

Is CVR the perfect way to measure true impact? No. But it is a helpful metric to understand the value of the traffic that is coming in as you decide where and when to double down.

There’s a huge variance of conversion rates across industries for AI-traffic.

To which we go: Oh? 30% for Healthcare? Well how is that traffic growing?

This is why running up traffic share and growth with CVR is useful. CVR alone makes you want to double down, while traffic share alone leads you to dismiss it.

AI traffic share in Healthcare did triple since January. But that’s an instance of compounding growth in small numbers. .03% to .09% doesn’t tell me to get off my butt and start investing in GEO. But it is a signal. A signal that some folks are starting to find their answers in LLMs and when they do? It’s a highly valuable answer to a human.

So now you have a methodology for tracking AI-traffic’s inputs over time between traffic volume, share of total traffic, and impact as measured through CVR. Like most people, you want to go start testing and experimenting to see if you can drive meaningful impact through AI on purpose.

Now what? Where do you start?

Is ChatGPT the LLM of Choice? Or is it Just the Name Everyone Knows?

This is a question we get a lot: Does optimizing for a specific platform matter? Is optimizing for one the same as all? Well, there’s still a lot to learn about the models behind each of these platforms.

One thing is glaringly true: ChatGPT dominates in AI Traffic.

But I wouldn’t count Perplexity.ai out just yet. Anecdotally, on our own website as we test and learn in GEO. We’re starting to see more often equal referral traffic from Perplexity vs. ChatGPT on the weekly.

And, you’ll see here that across our clients the CVR for the Perplexity sessions is on average the highest at 15.9%.

For context, the CVR for Organic Search in this study is 9.77%. That means that referral traffic from each of these LLMs above has CVRs higher than all of our Organic Search.

The Buyer Journey is Changing with LLMs

This is not some profound statement. Your buyers are finding you and finding answers to their questions about you in different ways. More complicated for the marketer to measure – less complicated for the user experience.

So you can’t use volume and CVR alone anymore to understand performance, but you believe your customers are getting to value faster. How do you prove your hypothesis?

Most of your customers finding you through AI are skipping the homepage.

About 7% of all AI sessions are going to the homepage, with the majority going to pages 2 or 3 levels deep in your site. This tells us a few things:

1. AI is doing a good job of taking your user’s query and matching it to the most relevant content

- The buyer journey is non-linear, as in your users are entering at a high relevance-to-need-match, without requiring awareness first

- You’re going to want to start thinking more intentionally about optimizations on your pages 2, 3, maybe even 4 levels deep

Don’t write off your homepage just yet. 2 things there (one rooted in data, one hypothesis to track):

- The Data: AI-Driven Homepage traffic converts at 23.03% (as compared to ‘Other’ pages converting at 12.72%). That tells you when your brand is mentioned and directly linked, there’s strong value there. So in those queries that serve up just a handful of brands. IF you capture that share, when they click through, almost 1 in 4 result in a conversion.

- The Hypothesis: Those brand mentions’ value may not be quantified by AI-traffic alone. Meaning, when there’s a relevant content match happening 2 pages deep in your site, the user needs that information at that moment. If there is a query that is surfacing your brand “in general”, that’s likely going to be more awareness, research type queries. If you see your visibility go up, will you see your branded search queries in google also increase over time?

Pressure testing this by industry will help you understand when you need to take action on these numbers.

Utilities

If you’re in utilities and you read the above, or any profound LinkedIn post on AI in general, you might be led the wrong way. Double clicking into utilities, our data shows a very different reality:

- Most of the traffic (by a lot) goes to other pages

- Those pages have a solid CVR at 10.34%

- The traffic that does go to the homepage? Converts horribly relative to other pages, at .92%

If we’re talking focus and you’re in utilities, you’re focused on page relevance. But keep your eye on AI visibility and branded search traffic to not lose sight of those key signals.

Ecomm

If you’re in eComm:

- Non-Homepage pages are far and away your priority

- But that Homepage CVR is looking healthier at 7.05%

It’s important to contextualize the CVR here while 7.05% looks like a bummer compared to the rollup 23.03%, among the other Organic/Direct channels in eComm, AI is sitting at 2nd to top CVR:

CRO improvements and tracking branded search volume changes can help you validate if you can capture and convert that homepage traffic as well as other industries and if you’re starting to see more AI influence in your other KPIs

SaaS/Software

SaaS is a totally different story. Homepage traffic converts really, really well. And so do ‘Other’ pages.

- Homepage traffic is significant in SaaS/Software at 15.28%

- Which bodes well for the impact of that 50.96% CVR on the AI-driven homepage traffic

- Other pages get the lion’s share of AI-driven traffic at 84.72%

- AND Other pages convert at 23.59%

So in this study, SaaS/Software hasn’t broken the traffic share milestone of 1% – but it’s closing in at .71% (2.6X from January’25) and you’re seeing exceptional CVRs from AI traffic. Comparisons to other organic and direct traffic channels below show Organic Social as another strong converting channel. You’re seeing that the human, trust, value led content starts to take center stage.

Healthcare

Rounding it out with a very different industry: Healthcare.

- Homepage traffic gets a small share of total volume at sub-3%

- But that CVR is comparatively strong, so when they get there they convert at nearly 20%

- Other pages win across the board with 97%+ of total volume and a whopping >30% CVR on those pages

So like eComm and Utilities, we’re seeing low homepage traffic. But the similarities in that traffic pattern stop there with comparatively high CVRs.

However in Healthcare unlike the other industries here, AI-driven traffic is not the best or second best converting organic channel… in this case it’s the second worst.

.png?width=750&height=425&name=Study-Healthcare%20Study_%20AI%20CVRs%20(2).png)

So while as a non-healthcare marketing professional, I’m impressed by these high conversion rates, when viewed against Organic Search, for example, both the volume and impact are behind. They are non-trivial CVRs nonetheless, so I’d definitely be keeping an eye on AI-driven traffic, because looking at performance, it’s already in the same ballpark as channels who have done the time.

So what do we do with all this? The data is messy, the growth is uneven, and no two industries look the same. But the through-line is clear: AI-driven search is shaping buyer journeys in real life, and it’s doing it pretty quickly.

How Fast Should You Prepare for AI-Driven Search?

You already know the hype-cycles are diluting the point. So how do you take this, an interesting but not declarative or conclusive study and turn that into a next step?

Here’s your action plan:

- Measure it.

You can separate your AI-referred traffic on your own site quickly today, how it changes week-over-week and which model is sending the lion’s share of your AI traffic - Track behavior.

What pages are the LLMs sending your traffic to and how are they converting? This can start to give you clues as to what your customers who are in market are likely looking for. - Experiment early.

It might not be time to go all in on AI-visibility for you based on your data, but you’re likely already doing some level of CRO or SEO on your site where it would be easy to incorporate some simple GEO tests and see what happens, without spinning up a team. And I’m talking easy – check out one of our latest tests where I literally *just updated the text in the footer*.

You don’t need to move your whole budget tomorrow, but you do need to get moving. What those moves look like for you will be different than the next person based on your own data. Everything we’ve pulled together across our client data in this study you can pull in your own data. If you’re going to start somewhere, start there.

.png)

.png?width=750&height=425&name=Study-Utilities%20Study_%20AI%20Traffic%20%26%20CVRs%20x%20Page%20(1).png)

.png)