There are plenty of studies exploring how digital metrics influence AI visibility, but what about traditional marketing campaigns and investments?

Answering this question required us to take a big swing to answer the question: Do professional sports stadium sponsorships influence the AI visibility of their bank sponsors?

Our hypothesis was that these sponsorships lead to a stream of brand mentions and citations, sending a strong signal to LLMs connecting brands to their respective locations.

But how powerful is that signal?

To figure that out, we looked into the 21 banks that have active naming rights to a NFL, NBA, NHL, or MLB stadium to see how strong their visibility was in that stadium’s city vs outside of it.

TL;DR: Banks that sponsor a stadium are mentioned 3x more often in their stadium cities

In our experiment, stadium banks are 3.7x more likely to appear in AI Search in their home market (53.9% vs 14.4%) vs outside their stadium location.

Want to check out the methodology first? Jump to that section here.

Banks that sponsor local stadiums appeared far more frequently in their home city’s AI recommendations than elsewhere, suggesting that LLMs favor locally prominent brands in their respective markets.

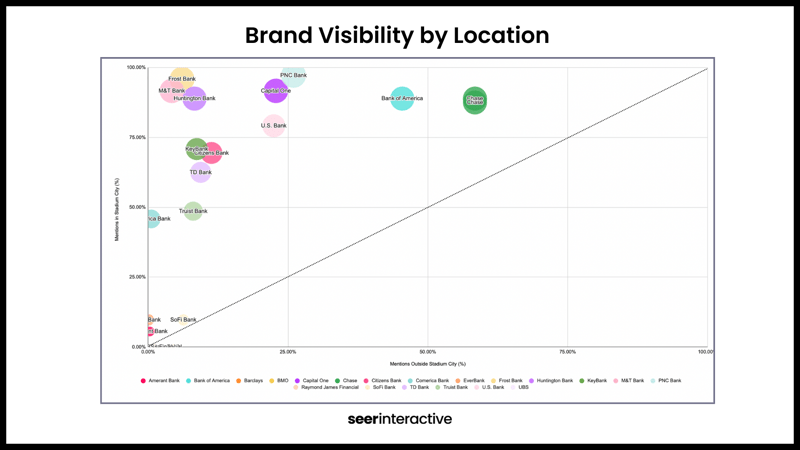

In the chart below, we plotted each bank included in the test. We only analyzed banks that have active stadium naming rights, and compared their visibility in the home stadium market vs outside that market.

Banks appearing above the diagonal line were referenced more often within their local markets - a sign of stronger localized brand visibility.

Across the board, banks had stronger AI visibility for prompts related to the location of their stadium vs elsewhere. There were only 4 cases where the home visibility was lower, more on that later.

The size of each bubble represents the total number of mentions a bank received in its stadium city.

Consistency Across Platforms

While the local visibility trend was overall consistent across ChatGPT, Perplexity, and AI Overviews, the magnitude varied in ways that suggest different optimization strategies.

ChatGPT mentioned stadium-sponsoring banks in 59.3% of responses, compared to 52.2% for Google AI Overviews and 50.2% for Perplexity.

That's a 9.1pp difference between the highest and lowest - not huge, but an indication that ChatGPT prioritizes locality more than Perplexity in this dataset.

This is where it would be important to look into the different web sources the LLMs were referencing. Do you have more or less brand mentions on the pages Perplexity is citing vs ChatGPT?

.png?width=800&height=450&name=Brand%20%25%20Visibility%20x%20Platform%20(1).png)

LLM Training Data vs Web Search

ChatGPT relied on its training data in 59% of the LLM outputs and utilized web sources in the other 41%.

The source used did impact AI visibility for banks, but both led to strong local visibility. Looking at the banks on an individual level, this is where we can see how the source type used can impact branded visibility.

%20via%20Web%20Search%20v.%20Training%20Data%20%20(1).png?width=800&height=450&name=Stadium%20Mentions%20(%25)%20via%20Web%20Search%20v.%20Training%20Data%20%20(1).png)

What about the historical impact of a branded stadium?

Looking into Wells Fargo, which historically had the naming rights to the Wells Fargo Center in Philly, gave us a perfect opportunity to dig deeper into the visibility shifts when ChatGPT uses training data vs web search.

- In the training data, Wells Fargo shows 100% visibility for the prompt “Give me bank recommendations for Philadelphia, PA,” compared to 62% visibility for non-Philly prompts

- However, when ChatGPT pulls from live web results, Wells Fargo’s visibility drops to 50% for Philadelphia-prompts and 44% for non-Philly prompts

The Wells Fargo Center in Philadelphia was still sponsored by the bank during the training data period, and has since been renamed to the Xfinity Mobile Center, which could explain the difference. The legacy name may have boosted Wells Fargo’s visibility in training data, while the live web now reflects the new branding.

Beyond Regional Reach

While regional banks like TD and Huntington naturally benefit from strong local footprints, national banks like Chase and Bank of America also showed their highest visibility in their stadium-sponsoring cities — reinforcing that localized brand presence influences AI Search visibility.

Not all stadium sponsorships drive equal lift

Four banks saw zero incremental visibility in their stadium cities despite multi-million dollar sponsorships:

- UBS (New York)

- Barclays (New York)

- BMO (Los Angeles)

- Raymond James (Tampa)

These banks are either competing in the largest markets of our dataset where national players are dominating AI mentions (NYC and LA) or fall into a separate category of banking (Raymond James not being associated with personal banking).

Meanwhile, regional banks in mid-size markets showed dramatically different results:

- M&T Bank (Baltimore): 91.7% visibility in stadium market vs 4.2% elsewhere

- Huntington Bank (Cleveland): 88.9% vs 8.3% visibility

- PNC (Pittsburgh): 97.2% vs 25.9% visibility

It was difficult for any brand to show relative lift in AI visibility with ‘stadium markets’ like New York or Los Angeles, indicating that in some cases market size matters more than brand size.

Mid-size metros like Baltimore, Cleveland, Pittsburgh, and San Antonio weren’t so saturated for the local brands to be drowned out by major players, but had strong enough media coverage to assist their AI visibility lift.

Before we get into the takeaways and implications, here was our methodology

Cities & Prompts:

We identified 49 U.S. cities with teams in one of the “Big Four” sports leagues (MLB, NBA, NFL, NHL) and ran a consistent prompt (“Give me bank recommendations for [CITY]” ) across ChatGPT, Google AI Overviews, and Perplexity.

Stadium Sponsorships:

We then mapped out banks that sponsor NFL, NBA, MLB, or NHL stadiums and linked each to its corresponding ‘stadium city’.

Of the 49 total cities tested, 21 have a bank that sponsors a local stadium.

Data Collection:

We tracked the prompt daily over the course of a month across all platforms, gathering 3,528 total outputs and averaging ~72 responses per city.

Local Bias Analysis:

We then measured how often each stadium-sponsoring bank appeared in its stadium city’s recommendations compared to mentions across other cities.

What this means

Stadium naming rights aren’t just about signage.

Traditional marketing and brand reputation tactics still matter - even in AI Search.

There is a measurable, incremental benefit for AI Search for brands that sponsor stadiums in mid-size markets. However, before considering stadium sponsorship, factoring in market size, investment vs. other tactics with similar digital impact, and what stage of the funnel you’re hoping to impact are key.

We don’t believe there’s anything inherently valuable for AI Search in sponsoring a stadium.

Rather, the residual impact of sponsoring a stadium - localized mentions, media coverage, social chatter - drives an increased signal of relevance that influences better local performance in AI Search. This checks out since acquiring the naming rights of a stadium — usually a brand awareness investment for a community — turns into an investment that increases brand awareness online.

So while there are enough assumptions to actually fill an NFL stadium, the link between brand awareness and AI visibility is hard to ignore, especially for banks operating at the local level.

Local authority + brand awareness are a heck of a combo

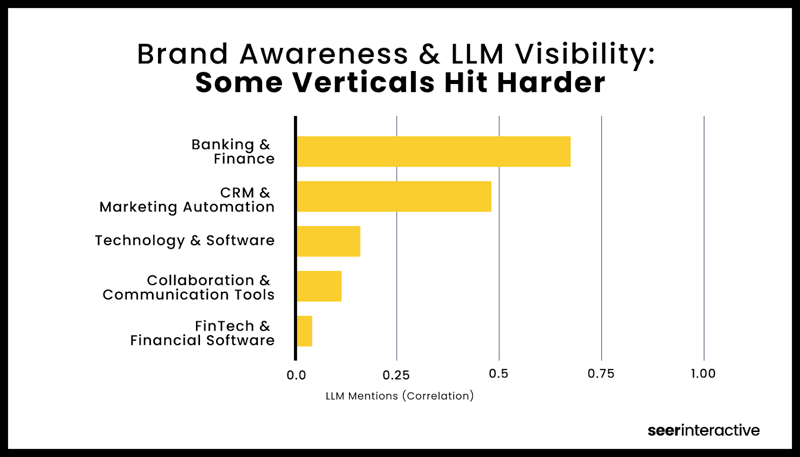

Our April study found that brand awareness carries the most weight in Banking and Finance - and this research backs that up.

This makes sense in an industry where authority and awareness are significantly valued. I have to know of and trust the brand before making a decision with my money.

Of course it helps to be visible in the traditional search results to be found, but I’m not so much thinking about the amount of backlinks their site has.

%20via%20Web%20Search%20v.%20Training%20Data%20Chart%20(1).png?width=800&height=450&name=Stadium%20Mentions%20(%25)%20via%20Web%20Search%20v.%20Training%20Data%20Chart%20(1).png)

Looking back at the chart, there were 2 cohorts of banks that stood out to me - the hyper-focused regional banks and the national players.

Hyper-focused regional banks

Take a look at Frost Bank and PNC. Frost operates solely in Texas and holds an impressive 96% share of visibility in its stadium market of San Antonio. PNC, available across 27 states, maintains 97% visibility in its stadium city of Pittsburgh.

Both brands illustrate how strong local authority can outperform reach - especially when LLMs connect brand mentions, local context, and awareness together.

Frost Bank has 77% visibility across all Texas-focused prompts, which is still ahead of other Texas-only banks:

- Texas First Bank: 7% visibility

- TexasBank: 5%

- Texas Community Bank: 1%

The strong brand awareness Frost has throughout the state, along with their local-focused media mix, helps them outperform other local banks and have greater visibility than national players like Chase (73%) and Wells Fargo (67%).

If I’m Frost Bank, I don’t necessarily care ‘how far to the right’ my brand sits on this chart and our visibility for a ChatGPT prompt “Give me bank recommendations for Charlotte, NC”.

What matters more is how visible I am in my addressable markets, take PNC for example:

- 9% AI visibility in states without a PNC branch

- 30% visibility in states with a branch

- 97% visibility in Pittsburgh, home of PNC Park

This pattern shows the lift in visibility as those connections strengthen, but what about banks that have branches available nationally?

National players

Even though Bank of America is a national brand, it has stronger visibility in Charlotte because local attributes semantically tie the brand to that location more closely than in other regions.

Same thing with Chase having the highest overall visibility among banks, it still sees a higher percentage of visibility in its “stadium markets" of San Francisco and Phoenix.

At the end of the day, local authority builds familiarity, and in an AI Search world, familiarity still drives visibility.

So, what is the value of this AI visibility?

Let’s take a step back.

Even before ChatGPT, stadium name rights were mainly considered a brand awareness investment that didn’t have a hard ROI tied back to it.

Katie Perkins, an Account Director at Seer with experience managing brand visibility, awareness, and reputation, mentioned that brands who invested in stadium naming rights typically get:

- A favorable digital branded asset - Designed to rank well organically for the brand

- Brand mentions and linking opportunities - Linking directly to the stadium page or serving as outreach opportunities for other assets (linking to social platforms or microsites)

- Visibility into what media mentions were driving engagement - tools like Memo.co give a sense of how much of the audience were reading positive / negative media coverage.

“Costs of these sponsorships can be substantial, so it’s helpful to negotiate digital terms at the time of engagement. Making things like brand mentions, directing where links should go, and what digital assets are included for the stadium part of the contractual engagement are usually easier to do at the start when that sponsorship fee is yet to change hands,” Katie says.

Taking a shot at what this visibility is worth

Going back to our research, banks had an average AI visibility of 53.9% in their stadium city, compared to 14.4% outside of it.

So if a bank is roughly 3x more likely to appear in AI search results for prompts like “Give me bank recommendations for [CITY],” we’ll have to make a few assumptions to understand the ROI.

- Let’s estimate that around 10,000 users in a given city turn to AI search for banking recommendations each month while we’re waiting on LLM search volume.

- At that scale, a visibility rate of 53.9% versus 14.4% would mean roughly 5,390 AI search appearances per month, compared to 1,440. This leads to a difference of +3,950 appearances monthly, or about 47,000 more AI impressions annually.

- Assuming these searches are high-intent at a 2–3% conversion rate, that lift could translate to roughly 940–1,400 new accounts / applications per year.

Using $400 as a conservative per-account value, the incremental revenue could be $376K to $560K annually stemming from stronger brand awareness and local AI visibility.

Taking another step back, typical stadium naming rights can cost an average of $7.4 million per year.

$380K-$560K in AI-driven value represents roughly 6% of a typical sponsorship cost, but of course that's not the whole ROI story.

Stadium sponsorships have historically delivered value through traditional brand awareness, media coverage, and social amplification. What's new is that we can now quantify the AI Search component of that equation.

For banks in high-performing markets (like M&T in Baltimore or Huntington in Cleveland, where we saw 85%+ visibility), the AI visibility piece may represent a meaningful and measurable component of the sponsorship's total value.

If you’re a marketer at a bank, start by digging into your own analytics.

Does your institution sponsor a stadium or have a strong hyper-local presence? Is there a smaller scale but still significant opportunity to sponsor an entity that’s often referred to in your target location?

Compare AI referral traffic from those markets versus others — it’s a simple way to gauge how much that local brand focus might be influencing your AI-driven visibility.

I don’t have a ‘stadium sponsorship’ budget, what should I do?

This study was meant to gauge the impact of local signals at its strongest point through stadium sponsorships. And while the study focused on the effects of offline visibility, a strong digital footprint can drive similar results.

What you can do instead:

-

Localized content strategies - Region-specific pages, press coverage, and partnerships that semantically tie your brand to key markets.

- Community-driven initiatives - Sponsoring local events and partnerships. At a smaller scale, these naturally earn mentions in local media and create the geographic associations.

- Earned media focus - Driving frequent brand mentions across reputable publications and social platforms. In another test we ran, we found that repetitive brand attributes - even something as basic as the "About [Brand]" boilerplate in press releases - can influence how LLMs reference and summarize your brand.

Katie mentioned: “If stadium sponsorship level of investment is out of reach, we’d encourage brands to find other, most cost-effective ways to mimic a similar digital local footprint: ensuring local citations out there and correct, sponsoring smaller community events and asking for brand mentions and links, and offering quotes to local media outlets can create many of the same digital signals that a larger sponsorship would garner.”

Stadium sponsorships generate AI visibility because they create a steady stream of contextual brand mentions, not because of the physical sign. If you can generate that same mention volume through other channels, you can potentially drive similar AI visibility lift.

.png)