CFO’s, Procurement, & Controllers are hitting you up:

“I need to make cuts. I need answers in 24 hours.”

You, the marketer, have no choice -- you have to come back with where you are going to make cuts and the clock is ticking.

If someone had to cut your pinky toe off, would you rather them use a sledgehammer or a scalpel? It's going to hurt either way, you’ll survive either way, but one can bring a LOT of collateral damage.

We aspire to help our clients avoid collateral damage and we do it with data.

The Data Scalpel

At Seer we have scalpels (data warehousing + data engineers) and surgeons (data strategists) who know how to use them quickly. That is a distinct advantage for our clients at this time of uncertainty.

We pull every ranking, for every keyword, for every client from their paid accounts every 24-48 hours. This gives us a treasure trove of data to be a beacon for marketers in stressful times like these.

Going with your gut or experience at times like these is RISKY, and it's a competitive disadvantage

All of those analysts out there that “bugged” you over and over again about getting your data solid? This is an example of what they were trying to help you with. Having good, clean, and normalized data when marketing in a recession is even more valuable because mistakes are even more costly. You may have been able to get by before relying on your gut and then pivoting if it didn’t work. But in a recession, going on gut can cost you in ways you can't as easily bounce back from.

It's not enough to have the data, you must have done the hard work to make it accessible to your surgeons -- the data strategists.

The last 3 years we’ve invested in big data, data engineering, and machine learning have put us in the position to help our clients at scale, in seconds during these unprecedented times. Four data strategists invested a total of 24-ish hours leveraging our data warehouse connections and front-end business intelligence templates.

Within 24 hours our clients were empowered to walk into a CFO's office with a tool that can answer tough questions about budget cuts on the fly.

Behind the scenes we had analyzed 2.3 million keywords in 24 hours. 3 days later every client had a personalized video walkthrough with risk assessments for each search term they ever bid on in the last 12 months. This was instantly editable / searchable / groupable on the fly for the Seer team, no "let me go pull that data for you". We were read to act right in that meeting with the CFO if we were needed.

Cutting Budget with Search Marketing BI

Search Marketing Business Intelligence is derived from taking integrated search data from the macro down to the most microscopic level. From there, we can quickly surface and test hypotheses.

In our efforts to help our clients quickly make decisions on where to make precision budget cuts, we had a handful of hypotheses:

Hypothesis #1 - You own prime real estate in SEO (Top 3), cut here first

If a client ranks in the top 3 organically, they have a chance to get that traffic and conversions without a paid ad.

In spite of organic showing up lower and lower, if you have to cut somewhere you might consider starting here.

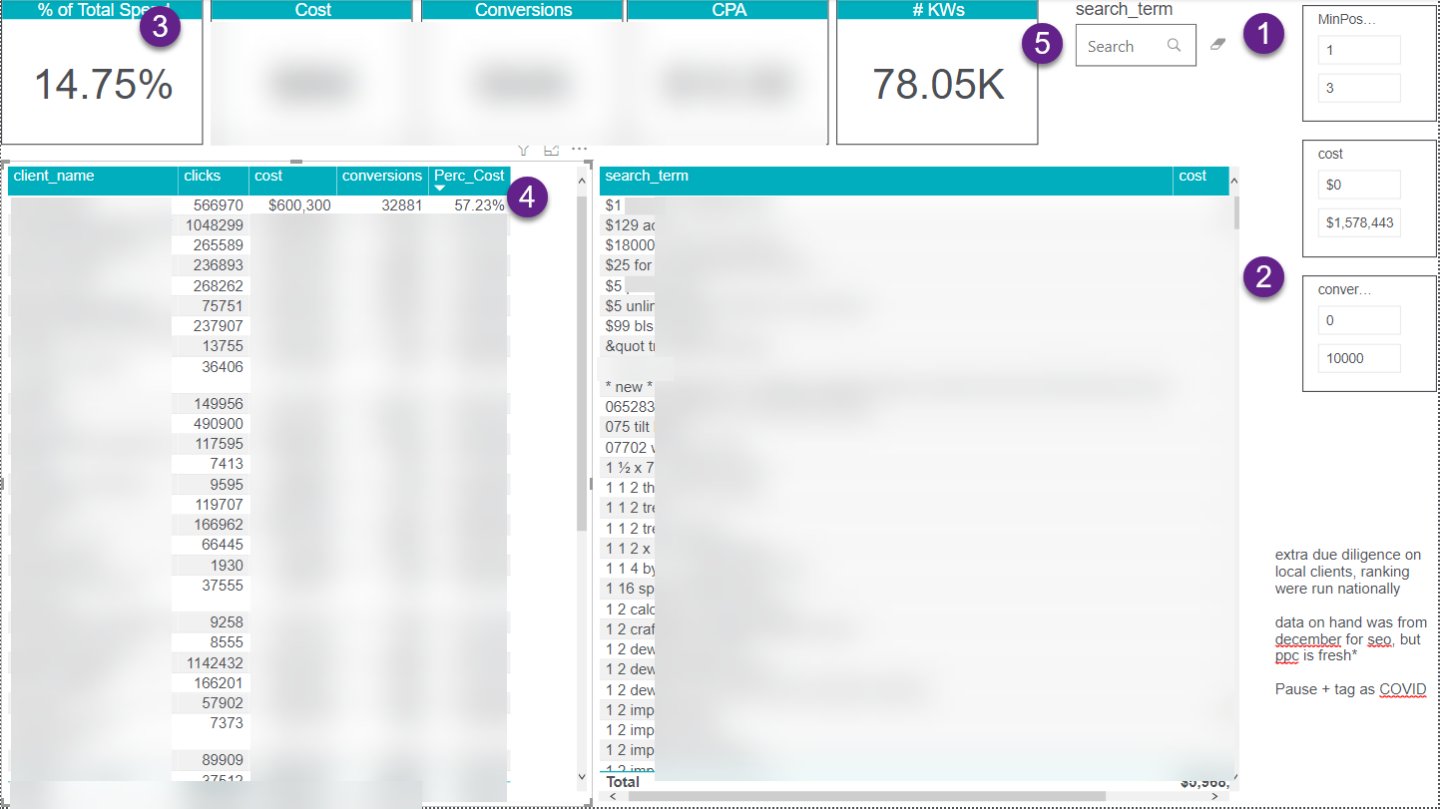

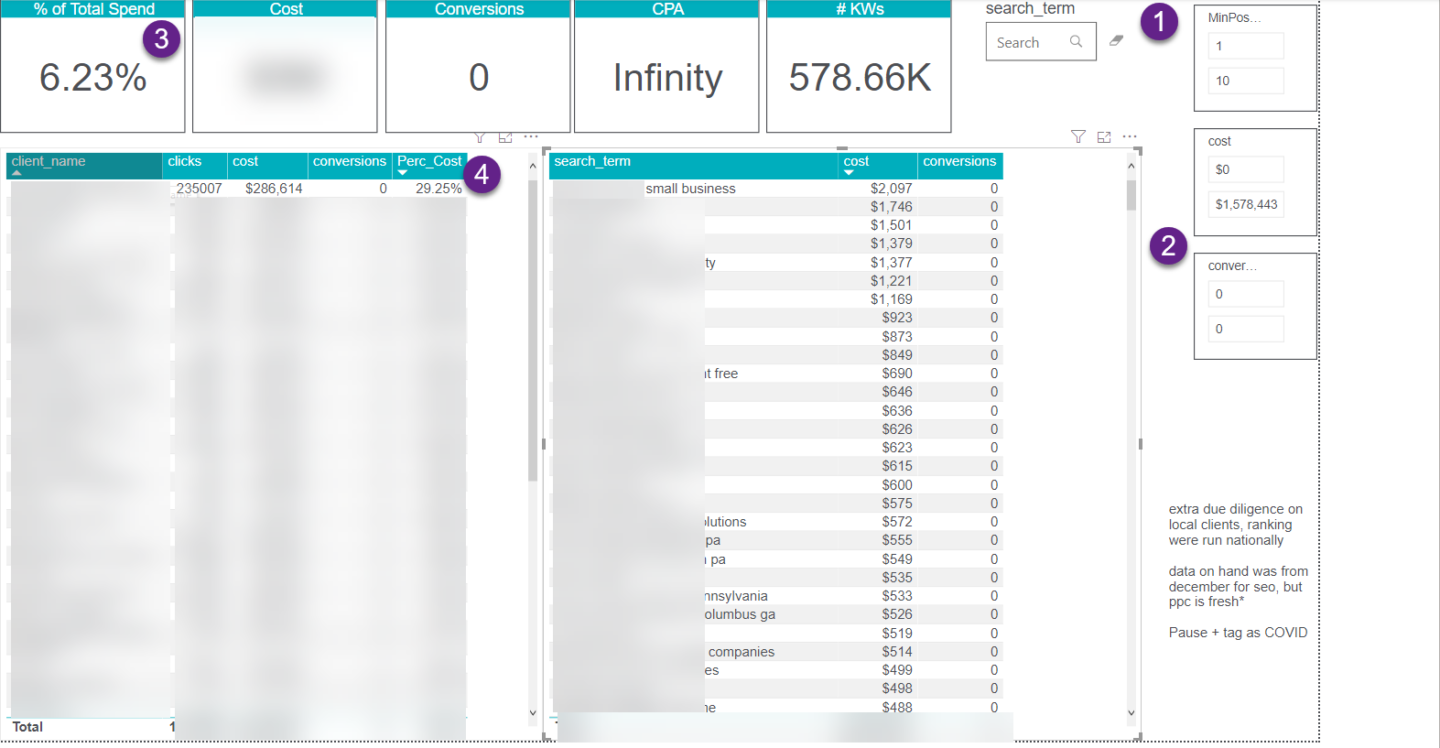

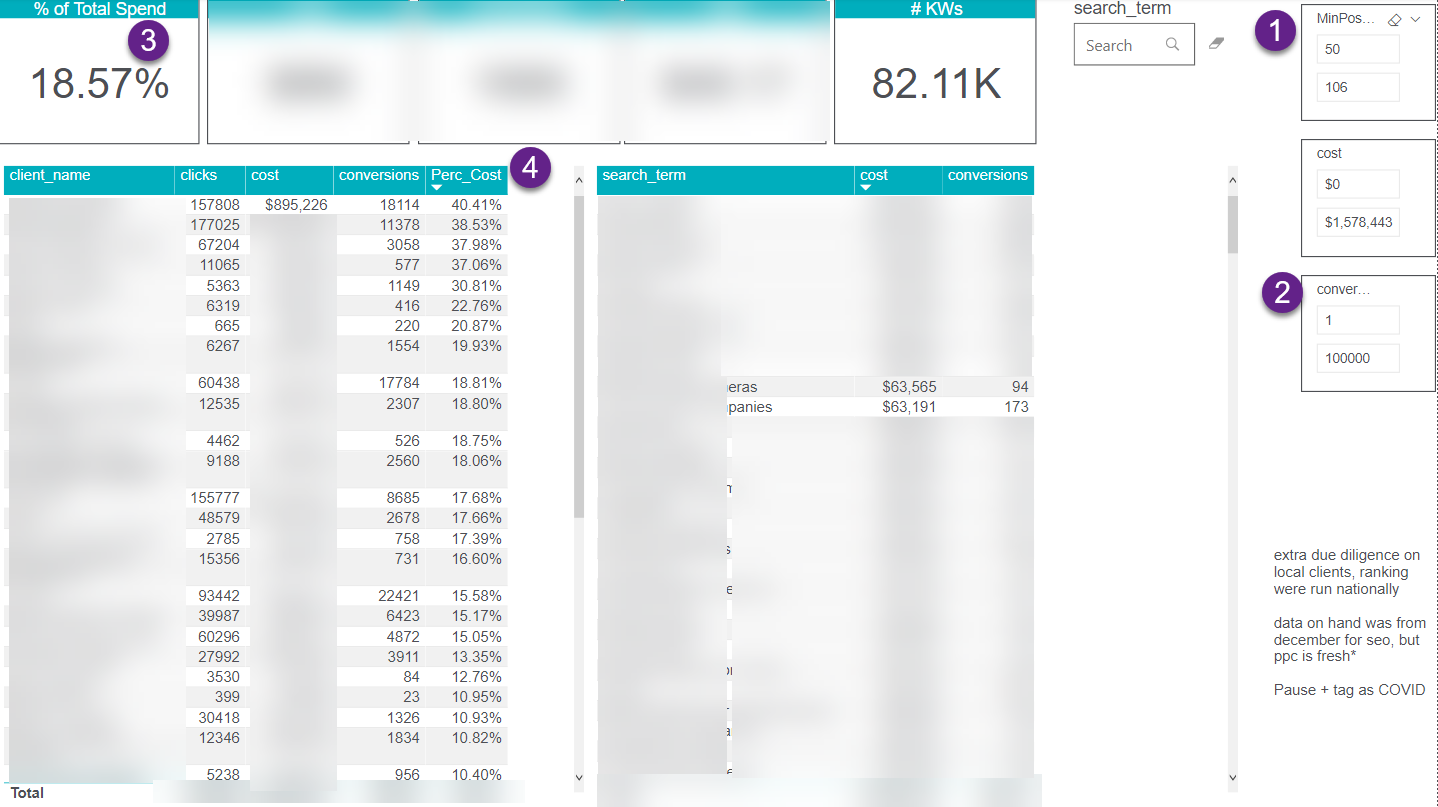

Below is our Power BI dashboard for every keyword for every client. This is our starting point for all of the hypotheses below.

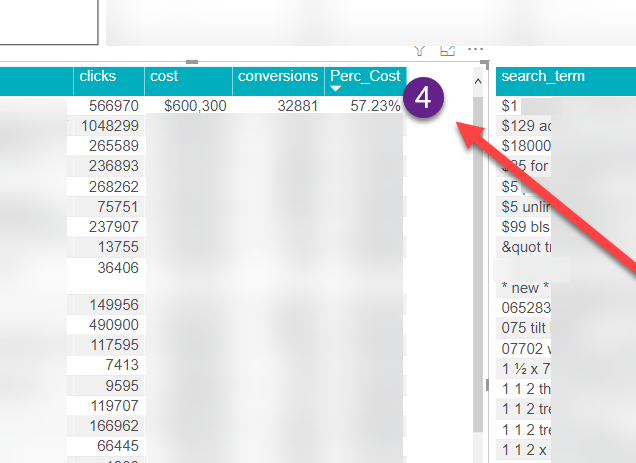

Data Breakdown: #1 - Where do we rank top 3 #2 - With minimum of .1 conversions (words that drive value) #3 - What % of all client spend fits this criteria #4 - Sort by % client PPC spend -- as you can see I have 1 client who spends 57.23% on keywords that rank top 3 organically.

WE DO NOT JUST RUN AND NEGATE THESE.

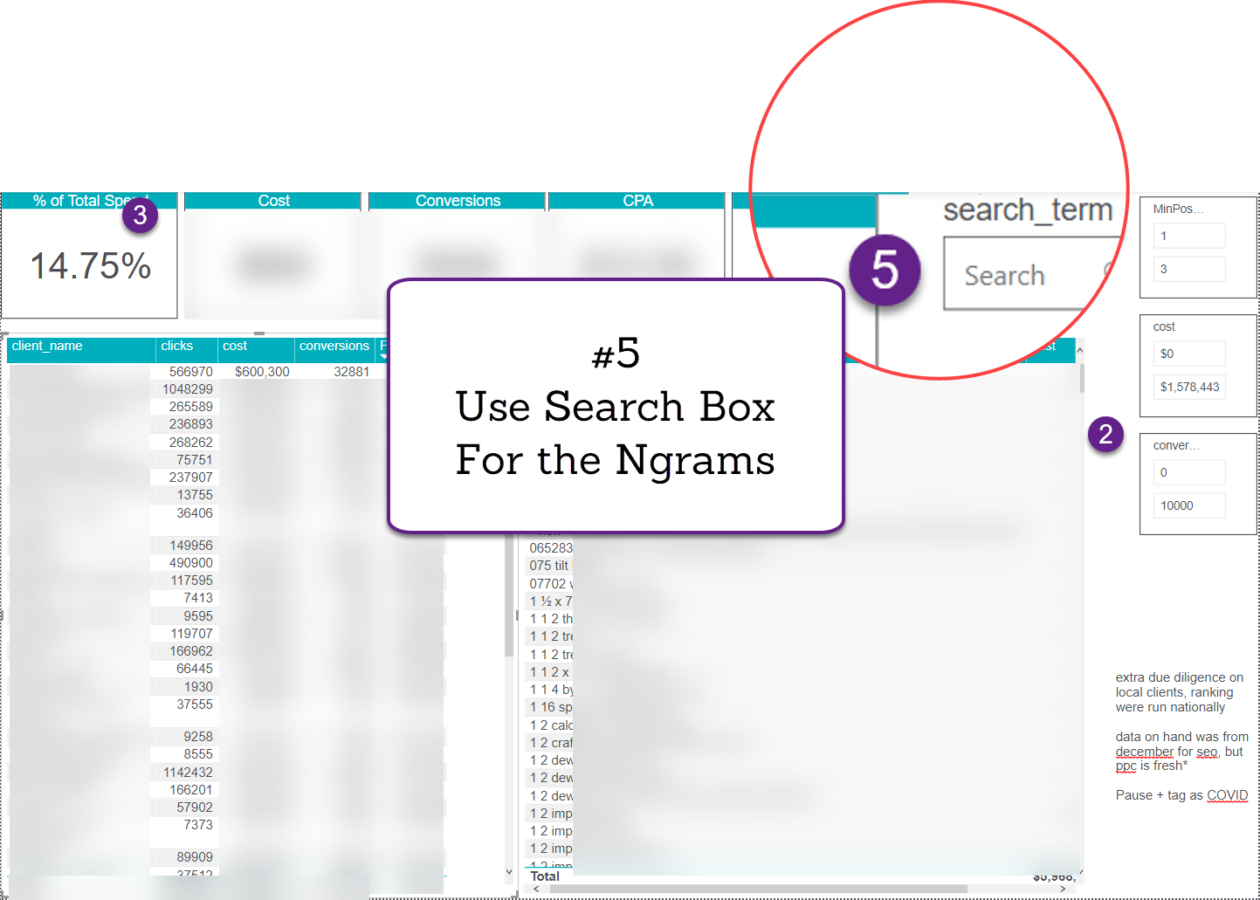

I’d recommend running them through an n-gram tool to find groupings, then consider negating.

Once we find those n-gram groupings, we search for them in #5 to really add precision:

We can run these in under 30 seconds for every client.

Insights to Advice to Action:

As you can see for client #1 below, we can tell them -- hey, if your CFO comes in and says “we need to cut 5%,” we have them easily covered. 15%? Same story. 50%?! Ehh, not so much. So we’ll have to go to another hypothesis to find more precision cuts.

Now for the Caveats:

I get there’s a lot of other factors that impact conversions like snippets, industry, intent, CTR, how competitive the auction is, etc.

Our clients have to make decisions quickly right now and I wanted to support them with the data we had, not the data I wish we had.

They were under pressure and we had data-informed answers at our fingertips.

If Hypothesis 1 isn’t enough to cut and folks needed to go deeper, that led us to hypothesis 2.

Hypothesis #2 - You got Page 1 rankings for keywords that have never converted, go here second for cuts

Keywords with a top 10 organic ranking where paid ads haven’t historically converted, still have a chance to continue getting that traffic without the paid ads.

I want that list of keywords where the number conversions are zero. The hope is to find another traunch to arm our clients with on where to strategically make cuts.

Data Breakdown: #1 - Where do we rank 1-10 #2 - With ZERO conversions #3 - What % of all client spend fits this criteria #4 - Sort by % client PPC spend -- as you can see I have 1 client who spends 29.25% in this grouping.

At this point you get it. By stacking these up we can help our clients know where to cut surgically in areas where they at least have a chance to get some traffic still. This arms them going into those tough meetings with CFOs.

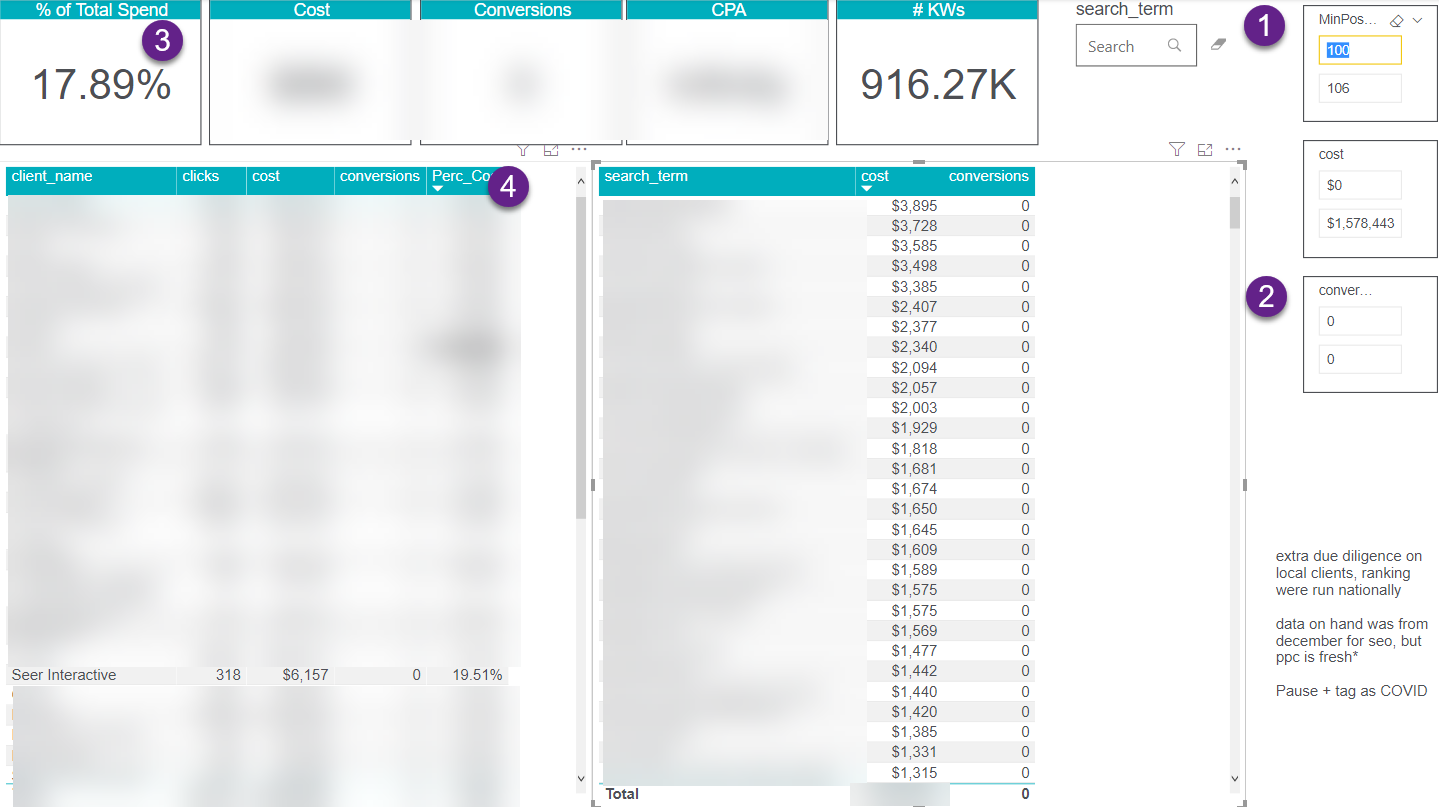

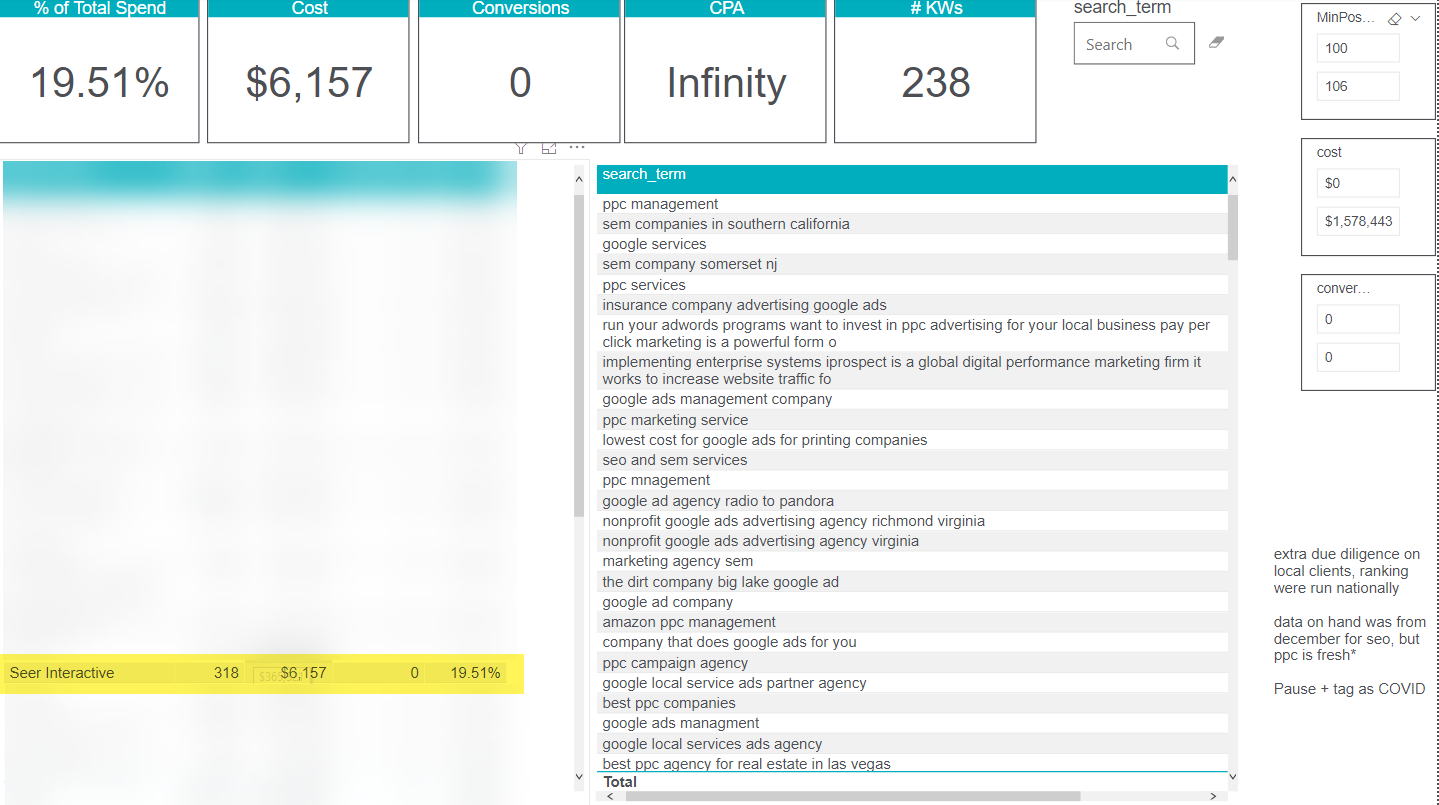

Hypothesis #3 - Why pay $ for a keyword you don't rank for that doesn't convert?

The task here was to find out how much a client has spent on a keyword that has never converted AND they don’t rank in the top 100. This could be another area to find cuts in seconds.

Data Breakdown: #1 - Where do we rank 100+ #2 - With ZERO conversions #3 - What % of all client spend fits this criteria #4 - Sort by % client PPC spend, as you can see Seer has spent 19.51% on keywords that I don’t rank in the top 100 AND they've never converted.

Here is where consulting is CRITICAL. Search Marketing BI can raise a flag, but the consultant needs to dig in further to make a data-informed decision.

A singular sale for Seer would be huge. So just running off and negating the list of words is a BAD idea without qualifying it.

Using Seer’s data we can dig in. Looking at the terms below, if they were still running I’d probably want to negate most of them:

This is the scalpel! I’m seeing things in here that make me say, oh most definitely cut that crap for now.

Back in the good old days, the revenue was growing enough to offset the more macro management of campaigns. Now, a positive ROI that hides inefficiencies isn’t good enough anymore. We need to FOCUS EVERY DOLLAR on things that have a chance to help our clients win.

But it's not all just about cutting the paid budget. There’s some work for the SEO teams to do as well...

Content Strategy with Search Marketing BI

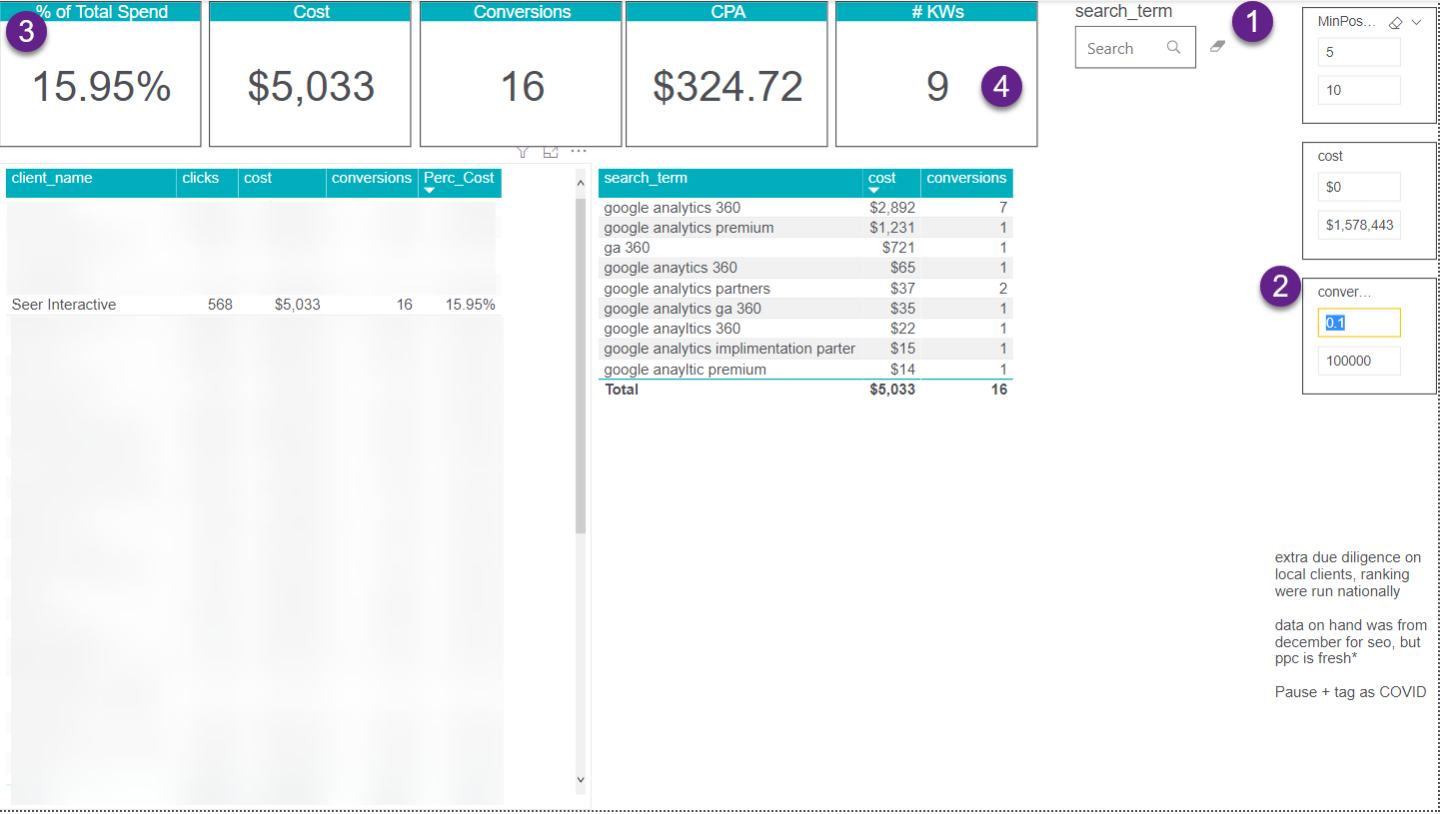

Hypothesis #4 - Improve rank now, so you can cut spend later

Paid keywords that convert and rank organically between 5-10 can be cut with minimal conversion impact if we improve organic ranking into the top 5.

Where am I bidding on words that ARE converting, AND rank between 5-10? The hope here is that if I can improve my ranking I might get up in that top 5, which might give me an opportunity to CUT spend.

Data Breakdown: #1 - Where do we rank 5-10 #2 - With conversions #3 - What % of all client spend fits this criteria #4 - Sort by % client PPC spend -- as you can see Seer has 15.95% of all of our spend came in this cohort.

Does this mean GO RUN, Optimize those pages? NO.

This is where consulting, understanding the business and business goals comes into play.

What are our margins on this part of the business? Is this a growth area for the business? What is our retention on clients through this channel? This is the hand off from our data strategists to the day to day consultants on the account team to use this search marketing business intelligence in conjunction with their account knowledge and consulting chops.

Hypothesis #5 - Double down on content production for converting keywords, get some of that traffic for FREE

Highest converting paid keywords where organic rankings are 50+ are content opportunities that can help us eventually rely less on paid.

When you are trying to figure out, what content do I produce to help my company right now, well this is a place to grow. This helps me prioritize going after keywords with a high propensity to convert. (Side note: Check out our YouTube video on how we determine what is the singular most important piece of content you should be making right now, backed by a review of 500k+ competing URLs.)

Data Breakdown: #1 - Where do we rank 50+ #2 - With high conversions #3 - What % of all client spend fits this criteria #4 - Sort by % client PPC spend this is how you instantly find your clients who are not investing properly in content at scale. This is your growth opportunity - start making that content to get into the first page.

What Now?

In uncertain times, marketers don’t have the runway to make the mistakes we could get away with just 4 weeks ago. Having your data accessible and ready to go will help you make smart decisions and smart cuts.

If you are thinking, damn I don’t have all this -- remember these things:

- We have YouTube tutorial videos where we show you how to DIY.

- Don't have DIY time but still want to find inefficiencies? Contact us ASAP!

- Check out this quote (it's a great reminder!):

If you’re building this out yourself, make sure you sign up for our email below to keep an eye out - we intend to add other qualifiers to this analysis, snippets and CTR from Google Search Console to name a few.

Hang in there y’all!