When it comes to understanding how you stack up against your competition, there is no better tool for paid search marketers than the auction insights report. The staple of any competitive analysis, auction insights helps marketers uncover how the presence of competitors impacts their Google Ads performance.

In this post, we’re digging in on how you can use auction insight to make strategic optimization decisions to improve your campaigns.

What is the Auction Insights Report?

Every time a user performs a search for one of your keywords, Google runs an ad auction in the background to determine which ads serve and where on the search results page they should appear.

The auction insights report helps paid search marketers understand how they match up in these auctions against other advertisers.

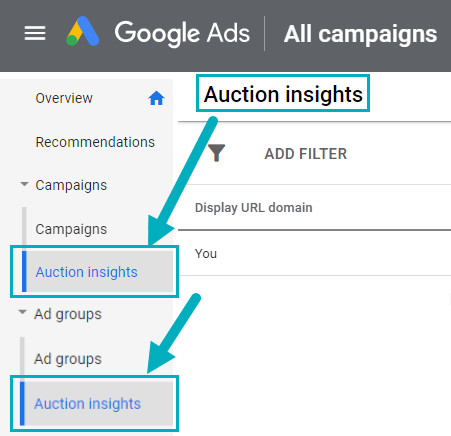

How to Access in Google Ads

- Select the specific campaign, ad group, or keyword by checking the box next to each item.

- Click on Auction Insights.

What Does the Data Mean?

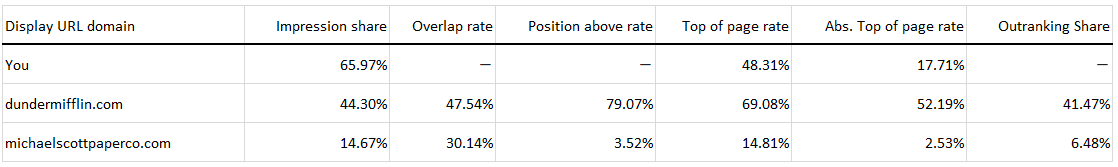

In Google Ads, the Auction Insights report for Search campaigns reveals five different important data points for you and your competitors: Impression Share, Overlap rate, Position above rate, Top of page rate, Absolute top of page rate, and Outranking share in your post.

- Impression Share: The number of impressions you received divided by the estimated number of impressions you were eligible to receive

-

This metric can be heavily related to ad spend, the higher the percentage, the more likely an advertiser is spending a higher amount for their ads to show in most of the auctions they are eligible to show in.

-

- Overlap Rate: How often another advertiser’s ad received an impression in the same auction that your ad also received an impression.

- In the example below dundermifflin.com is stronger competition because they have a higher overlap rate (47%) than michaelscottpaperco.com (30%).

- Since we see dundermifflin.com as a competitor in more of the same auctions our ads show up in, then we can conclude they likely have more similar targeting (audience, keywords, product listing) to our ads than michaelscottypaperco.com.

- Position Above Rate: How often another advertiser’s ad in the same auction shows in a higher position than your own when both of your ads were shown at the same time.

- Here you'll see when dundermifflin.com shows ads at the same time as us 79% of the time they show above our ad, where michaelscottpaperco.com only shows above our ads 3% of the time when we appear in the same auction.

- This is an indicator that we should dig into dundermifflin.com to see why their ads are showing above ours regularly.

- Top of Page Rate: How often your ad (or the ad of another advertiser, depending on which row you're viewing) was shown at the top of the page in search results.

- The higher your percentage here the better. If you are seeing a low percentage here evaluate your ad strength, your bids and your keyword quality.

- In the example below dundermifflin.com has a higher top of page rate(69.08%) and a higher overlap rate (47.54%) meaning their ads are stronger competition on paid search than michaelscottpaperco.com which has a lower top of page rate (14.81%) and lower overlap rate (30.14%).

- Abs. Top of Page Rate: The percent of your impressions that are shown as the very first ad above the organic search results.

- This metric is similar to top of page rate except here we are only looking at the very first position and not the few positions above the organic search results.

- We can see that dundermifflin.com is capturing that first position more often than michaelscottpaperco.com and our own ads. This could be due to the keywords we are looking at (if we are only looking at a competitor campaign) or could be another reason relating to our ad rank.

- Outranking Share: How often your ad ranked higher in the auction than another advertiser’s ad, or if your ad showed when theirs did not.

- In the example we can see that our ads ranked higher than dundermifflin.com 41.47% of the time while only ranking higher than michaelscottpaperco.com 6.48% of the time.

- In the example we can see that our ads ranked higher than dundermifflin.com 41.47% of the time while only ranking higher than michaelscottpaperco.com 6.48% of the time.

How to Interpret Auction Insights Data

The data provided by auction insights can help marketers answer a number of questions, like:

- How is the presence of a competitor affecting my account performance?

- Are my CPCs affected by the number of competitors bidding on a keyword?

- Are there new competitors bidding on our terms that weren't there before?

- Are there competitors that are bidding on our brand terms that we aren't bidding on their brand terms?

To answer these types of questions, you first must understand how to read the data. Let’s take a look at an auction insights report and see what sort of insights we’re able to derive for our enterprise-level office supplies client.

We can see that two of our competitors — Dunder Mifflin and the Michael Scott Paper Company — are competing in the same auctions as our client. Here’s what we can learn from this data.

Dunder Mifflin, an enterprise-level paper supplier, is our top competitor (by impression share), yet, we’re appearing in more auctions than they are. But, whenever Dunder Mifflin does appear in the auction, their ads serve in higher positions 8 out of 10 times (position above rate). Moreso, Dunder Mifflin ads are showing in the very first position half of the time! (Abs. top of page rate)

We can infer from this data that the paid search team at Dunder Mifflin is very interested in targeting the top of the page and may have deployed a bidding strategy to do this. We’ll want to run an analysis to see how their presence at the top of the page has affected our performance metrics, like cost, clicks, and conversions.

The Michael Scott Paper Company is a small, regional paper supplier. As an enterprise-level business, we’re not surprised to see that our client’s impression share numbers are much higher than theirs due to the fact that we likely have a much higher budget. While on the surface they don’t appear to be too much of a threat, we can’t discount them. We will want to check out what messaging they are using in their ad copy and landing pages and how it compares to ours.

This is a small example of the types of competitive insights and action items that are derived from auction insights. Read on to see ways you can dig deeper with auction insights data to inform keyword strategy and better understand the competitive landscape.

How to Use Auction Insights to Identify Gaps and Mine Opportunities

The above example outlined two examples of how auction insights data is used.

Let’s review a few other common scenarios that marketers face when reviewing auction insights and ways they can use the data to derive insights and inform optimizations.

Scenario: Why are the competitors listed in auction insights report not my direct business competitors?

There’s a good chance the keywords you’re bidding on may be too broad or irrelevant. Perform a search query analysis against these keywords to identify what users are searching for. If you find that these searches are irrelevant to your business, you may want to pause, negate, or narrow the targeting for those keywords.

If you’re finding that your keyword targeting is not hitting the mark and you need to identify new keywords to target, use organic data to help inform your pay-per-click keywords. Our SupernovaTM Techonology allows our team to cross analyze organic data with ppc data easily, efficiently and at scale making analysis like this a part of our everyday strategy!

Scenario: What should I do if I see that the competition continues to increase month over month in my top-performing campaigns and ad groups?

Use this data to inform budget increases for these campaigns to remain competitive. Depending on your business objective, you may want to explore testing Impression Share smart bidding to maintain impression share for these key campaigns.

If you’re seeing that a top-performing ad group operates in a competitive arena and is budget-constrained, consider breaking it out into its own campaign to provide more control over spend which can further enhance performance in the market.

Scenario: I’m unable to increase my budgets. What else can I do to stand out above the competition?

Perform Google searches, or use a tool like SEMRush, to compare competitor ad copy and landing pages, and look for ways to refine your own creative. Make note of the following in your research:

- What unique value propositions (UVPs) or promotional offers are competitors using across their creative?

- Which ad extensions have competitors deployed?

- What page features and content are displayed on competitor landing pages?

- What does the sign-up, lead generation or purchase process look like?

There are many ways auction insights reports are used to gain a better understanding of your competitors and provide the data that you need to be more competitive.