Consumers across all industries are living in a new normal.

With stay-at-home mandates continuing and rising unemployment rates, people have new considerations when conducting research and making purchases.

Marketing teams need to prioritize content that will answer current + timely customer needs to provide value and ultimately continue to drive revenue.

Companies that are staying afloat are rooted in helping their customers and are willing to pivot their digital marketing strategy and tactics.

Digitally savvy real estate companies continue to sell by highlighting home features online; eCommerce clothing businesses have shifted marketing budget to lounge and athletic-wear, and travel companies are driving engagement for later bookings with virtual “vacations.”

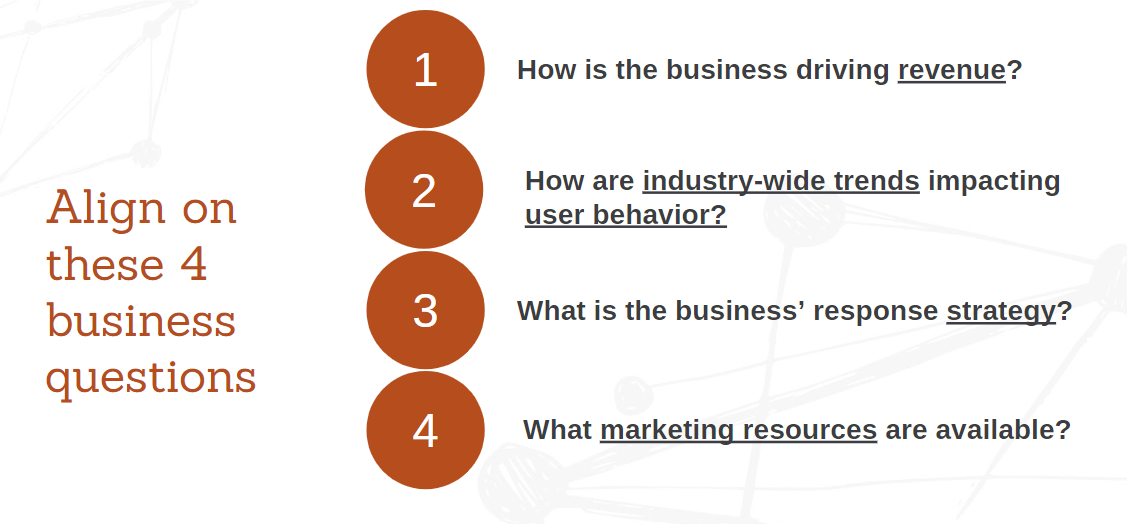

When developing a digital response strategy for your brand in this new business climate, evaluate these four areas (which I’ve compiled, and tested, after working closely with clients in various fields):

-

- How is your business currently driving revenue?

- How are industry wide-trends impacting user behavior?

- What is the brand’s response strategy and how does this stack up to competitors?

- What marketing resources are available?

1. How is the Business Currently Driving Revenue?

Marketing efforts should always be rooted in providing value by building brand equity and driving revenue. In the current climate, it’s even more vital that every marketing dollar is working to support customers and business health.

Before adjusting your marketing strategy, it’s vital to assess which products to focus on by reviewing customers' online behavior.

Use the following questions as guiding resources to evaluate needs for your brand:

Products Revenue/Leads:

- What products have increased, decreased, or remained flat in driving leads/revenue?

Engagement:

- Are certain topics or themes seeing an increase in demand or engagement?

- Does this vary by a user's geographic location?

- Does this vary by online channel (paid ads vs. organic?) Has traffic remained steady, while conversions or purchases have declined (indicating an interest, but change in conversion/purchase intent)?

Buying Cycle:

- Has your customer buying timeline remained flat, increased, or decreased?

- For example, Pre-COVID it took a user 3 days to make a purchase, now it’s taking 2-3 weeks post

Resources & Tools to Reference

- Full list of tools and reports to use when analyzing timely trends

2. How are Industry Wide-Trends Impacting Customer Behavior?

Once you’re grounded in how your business’ revenue streams have been impacted; it’s crucial to evaluate user behavior trends across your industry.

It's pretty safe to say that consumers in most industries have new concerns and needs in 2020, which is affecting how they spend their time and money.

- In the education industry, students are concerned about what a virtual fall semester could entail and how this will impact their education (source).

- In the SaaS space, businesses will have a rising need for cloud-based tools that function properly, easily, and successfully while team members are remote. (source).

- In the home cooking space, baking products like yeast, bread pans, and flour are spiking in interest in Google search (source), likely due to more time in the kitchen with stay-at-home orders.

Evaluate the following for your brand:

- What new concerns do your customers have in relation to your products, or about your industry in general?

- What questions do customers have or what new resources do your customers need to feel confident that they are making the right purchase and spending wisely?

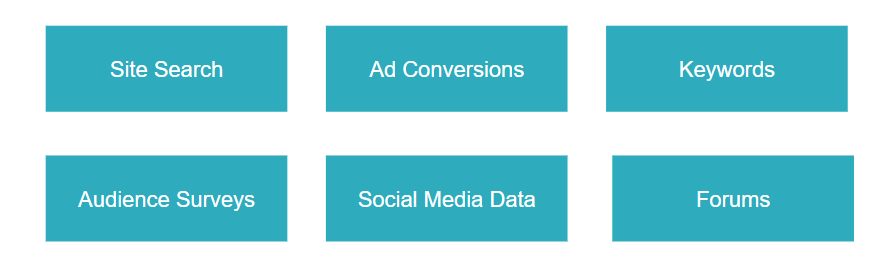

Data Sources To Reference:

- Site Search Data: Analyze common or rising searches users have using the search bar on your website.

- Paid Search Conversion Data: Review paid search ad data to uncover new variations of searches that are driving conversions (leads/revenue)

- Keyword Search Data: Review consumer demand using search data from Google and other search engines.

- Audience Surveys: Conduct qualitative surveys using Google Survey or tools like HotJar to gain further insight on rising questions or needs.

- Social Media Data: Review customers’ social media posts to gain insight into their current needs and questions about your brand.

- Forums: Mine and review how customers or potential customers in your industry are asking questions and seeking peer guidance on forums, like Reddit.

3) What is Your Brand’s Response Strategy and How Does This Stack up to Competitors?

How do you want customers to perceive your brand compared to competitors? Even if your brand chooses not to be a “first responder” in your industry, customers want brands to provide helpful information.

“For instance, almost half [of survey participants] (42%)* were keen for [brand] campaigns to be more informative, with almost a fifth (18%) looking for messages based around COVID-19 or insights into how the brand was supporting their staff and customers” (Source).

If you’re on the fence about building responsive content, consider the following questions:

- Where is your brand falling short on providing value and helping customers, where your competitors are hitting the mark?

- Where are competitors failing and leaving gaps where your brand could be providing helpful guidance?

- Have competitors shifted advertising budget and messaging? If so, on which platforms and what is their offering?

- Have competitors added new tools or resources? What value are they providing to their customers?

Data Sources & Tools to Reference:

- Competitor analysis: Analyze how competitors have expanded their reach in paid search or organic search

- Monitor industry news and publications: Using tools like Buzzstream and Talk Walker, you can monitor press mentions and trending news stories

4) What Marketing Resources Are Available?

Whether you’re facing budget cuts or doubling down on marketing resources, it’s important to pinpoint clear KPIs and project ROI for each marketing effort to ensure you’re spending wisely.

Evaluate each channel’s relevance and reach in the current climate; what will drive the most value for customers and drive return for your business?

Are your customers actively engaging on social media; while spending less time watching television or listening to the radio? If so, you likely want to invest in digital channels vs. more traditional means.

Tools & Supporting Resources:

- Building marketing KPIs

- Estimating ROI

Re-assessing your content strategy in the current climate is challenging; however, by digging into these four areas you can focus on building content that will drive impact for your customers - and your business!